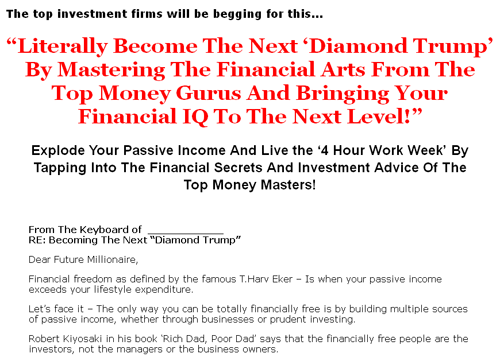

Salespage Snapshot:

Table of Contents

Foreword

Chapter 1:

Understand Priorities and Where You Are

Chapter 2:

Keep Track and Set Limits

Chapter 3:

Fix The Order Of What Gets Paid

Chapter 4:

Ways To Save Money

Chapter 5:

Bring In Some Extra Money With Technical Skills

Chapter 6:

Inventive Ways To Make Cash

Chapter 7:

Charge Cards and Borrowing

Chapter 8:

Techniques To get Finances Under Control

Chapter 9:

Additional Ways To Get Out Of Debt

Chapter 10:

Real Estate

Wrapping Up

Sample Content Preview

Chapter 1:

Understand Priorities and Where You Are

Synopsis

Scrutinize of your financial wellness! As well get your priorities straight.

Some individuals might make mistakes in setting their financial priorities like saving more for their children’s college education and a lesser for their own retirement.

The Start Point

-> What major fiscal challenges do you face?

-> State your financial positives in terms of revenue, debt management, and savings.

-> How do you think you arrived at this point—and what would you like to see altered?

-> How well organized are you for a financial emergency? Write it out now: The amount we have put away an emergency fund is _______.

-> How is the subject of money addressed in your family: emotionally or rationally?

-> Who makes the fiscal decisions? How come? How much collaboration is there?

Why it counts: Clarity and commitment. Authorities agree that before crunching the numbers, families need to scrutinize their financial wellness—and the best chance of success comes from having both mates on board.

Here we will explain to you the basic principle of personal financial ratio and its analyses. This will help you keep a tab on your personal finances.

Other Details- 5 Articles (DOC)

- Ebook (PDF, DOC), 78 Pages

- Salespage (HTML, PSD)

- Squeeze Page (HTML)

- Ecover (PSD, JPG)

- Keywords List (EXCEL)

- Special Bonus Preview Report (PDF, DOC), 25 Pages

- Promo Emails

- Thank You Page

- File Size: 27,171 KB